Are overdrafts and credit cards the right funding tool?

- Posted by Duografik

- On June 22, 2019

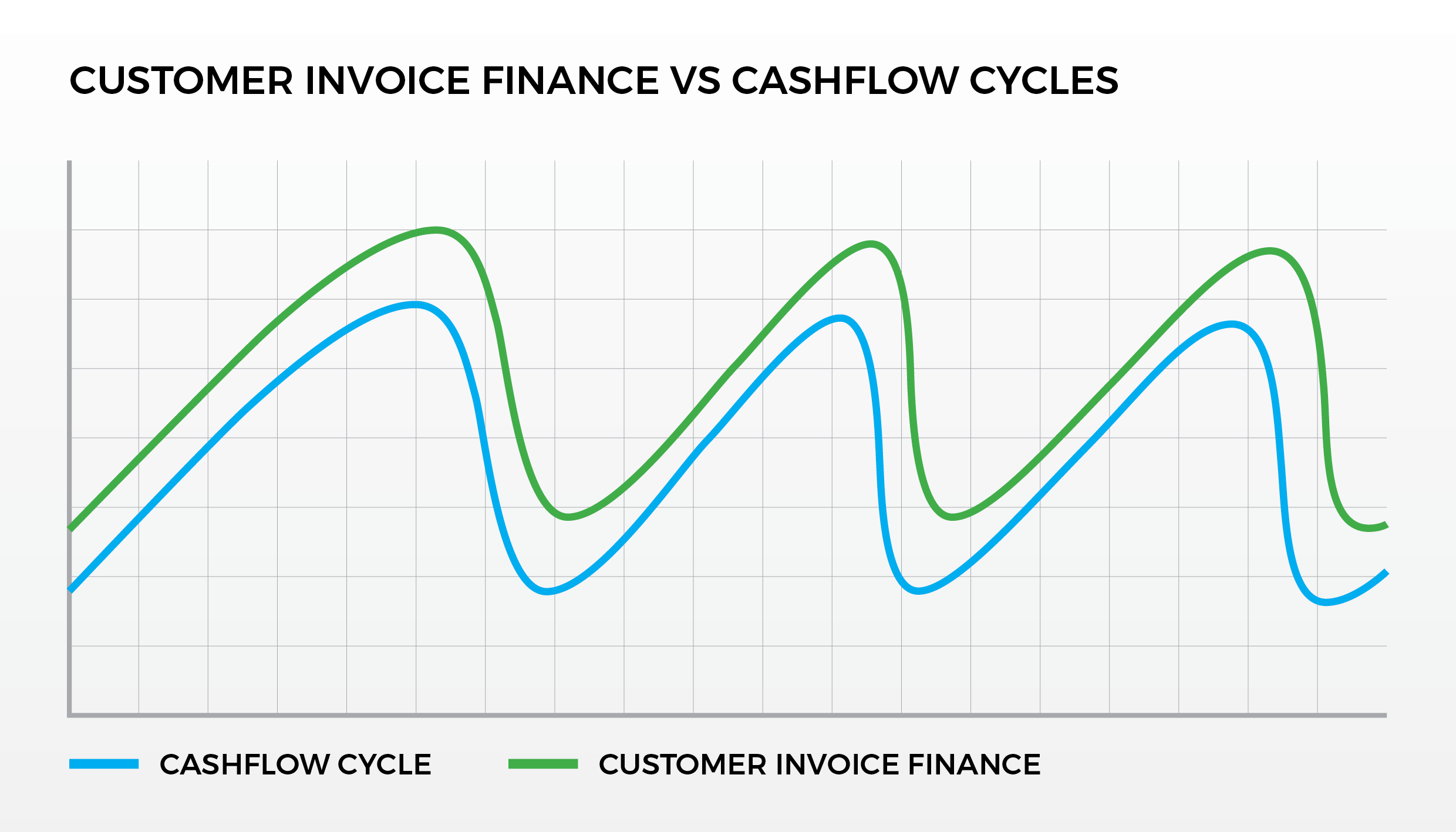

Over the past two or more years the biggest challenge for small to medium businesses is getting enough cash to effectively run the business. It’s not uncommon for a profitable business to have cashflow problems, and this is especially true when new growth and sales opportunities come up. There is a growing trend for extended […]

Read More