Keep the fleet rolling

- Posted by Duografik

- On October 15, 2019

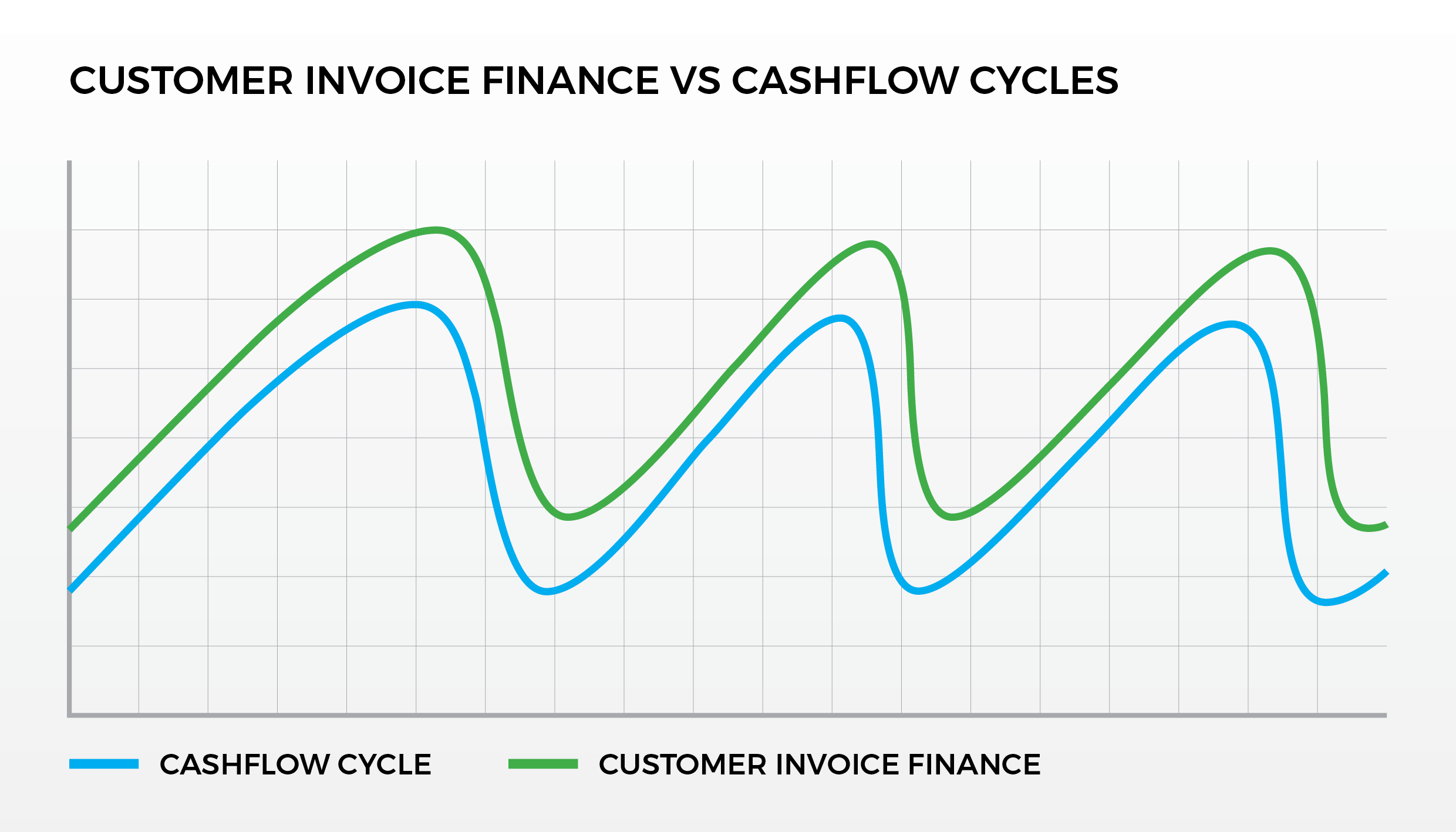

Businesses in the transport and logistics sector face many challenges trying to manage and maintain consistent cashflow having to juggle fluctuating fuel prices, tight margins, reducing numbers of skilled drivers, and ever-increasing regulation and safety obligations. Adding to the strain is the broader business issues of credit accessibility from mainstream funding sources and Customers […]

Read More