Cashflow Finance Comparison: Fintech Loan vs Customer Invoice Finance

- Posted by Duografik

- On May 8, 2019

- 0 Comments

- cashflow finance, customer invoice finance, debtor finance, fintech, invoice finance

Finding financial balance as a business owner is one the main problems affecting business growth. We all have these times where we feel we are on top of our finances and then find ourselves back where we started or behind. At AddCash Finance we call this the business cashflow cycle.

Going through your day to day finances involving sales, expenses, receivables and loans but rarely understanding how they fully interrelate to form the cashflow cycle, can harm the potential growth of your business. Understanding the cashflow cycle is the best way to find the right solution for you by comparing Fintech Loans and Customer Invoice Finance, AddCash Finance will help you find the right decision for your business.

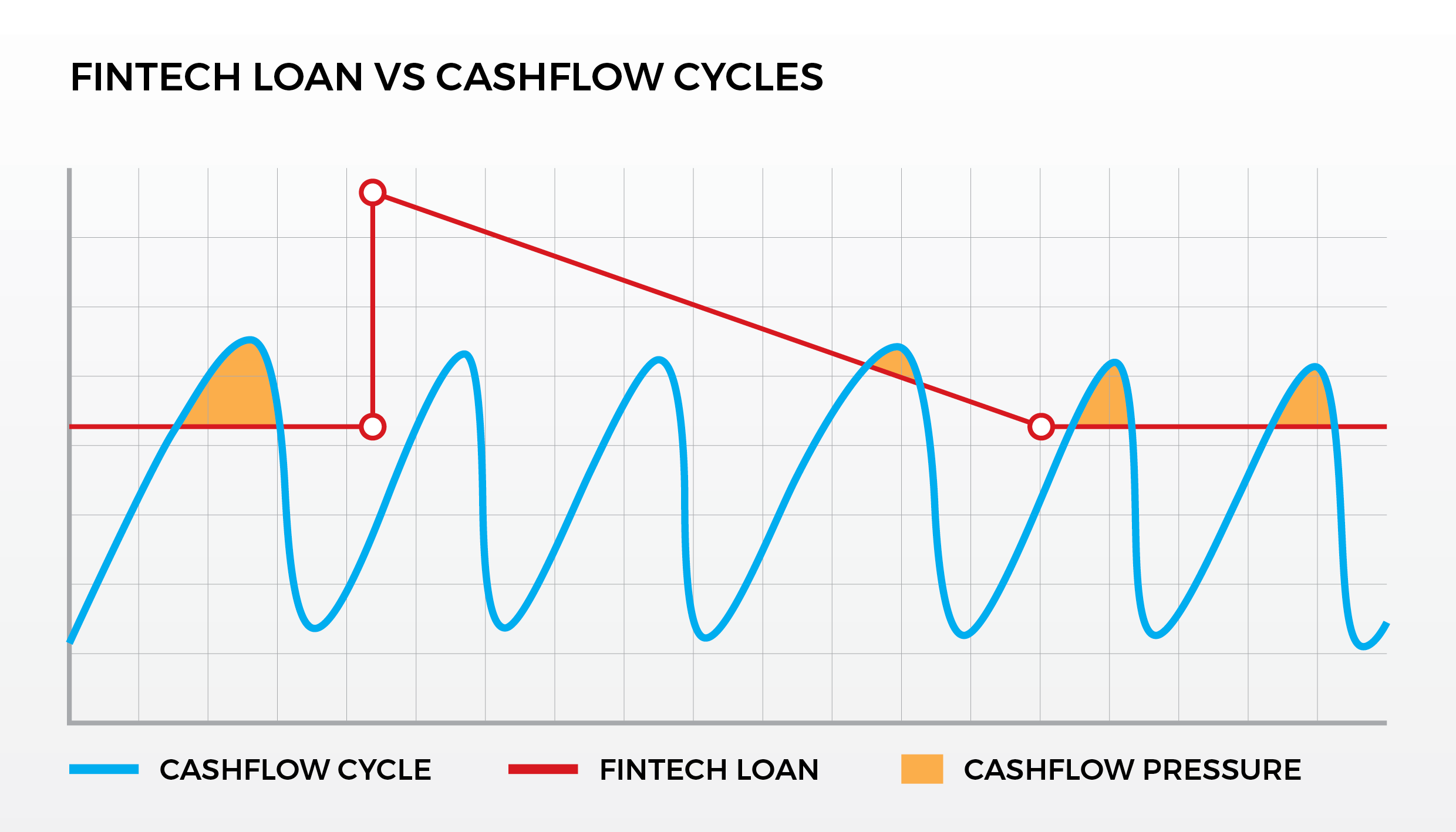

Fintech Loan vs Peak Cashflow Cycles

An increasingly popular solution is a Fintech Loan, which is a short-term business loan commonly offered by an online lending company who enables a range of financial services. Fintech Loans are great for fast money as they typically do not require property security, they are quick to set up and focus their credit assessment on bank statements rather than financial accounts.

However, they are a onetime only cash advance that must be repaid over a short period via equal repayments each day, week or month. Consequently, businesses only experience temporary cashflow relief before they find themselves back where they started. The cashflow pressure illustrated below (refer image 1) is when the peak of the cash cycle goes above the red line representing a Fintech Loan.

As Fintech companies will rarely allow you to borrow again until you have paid off the remaining money owed. Once this is complete you can then start the process again by applying for another short-term loan.

Image 1

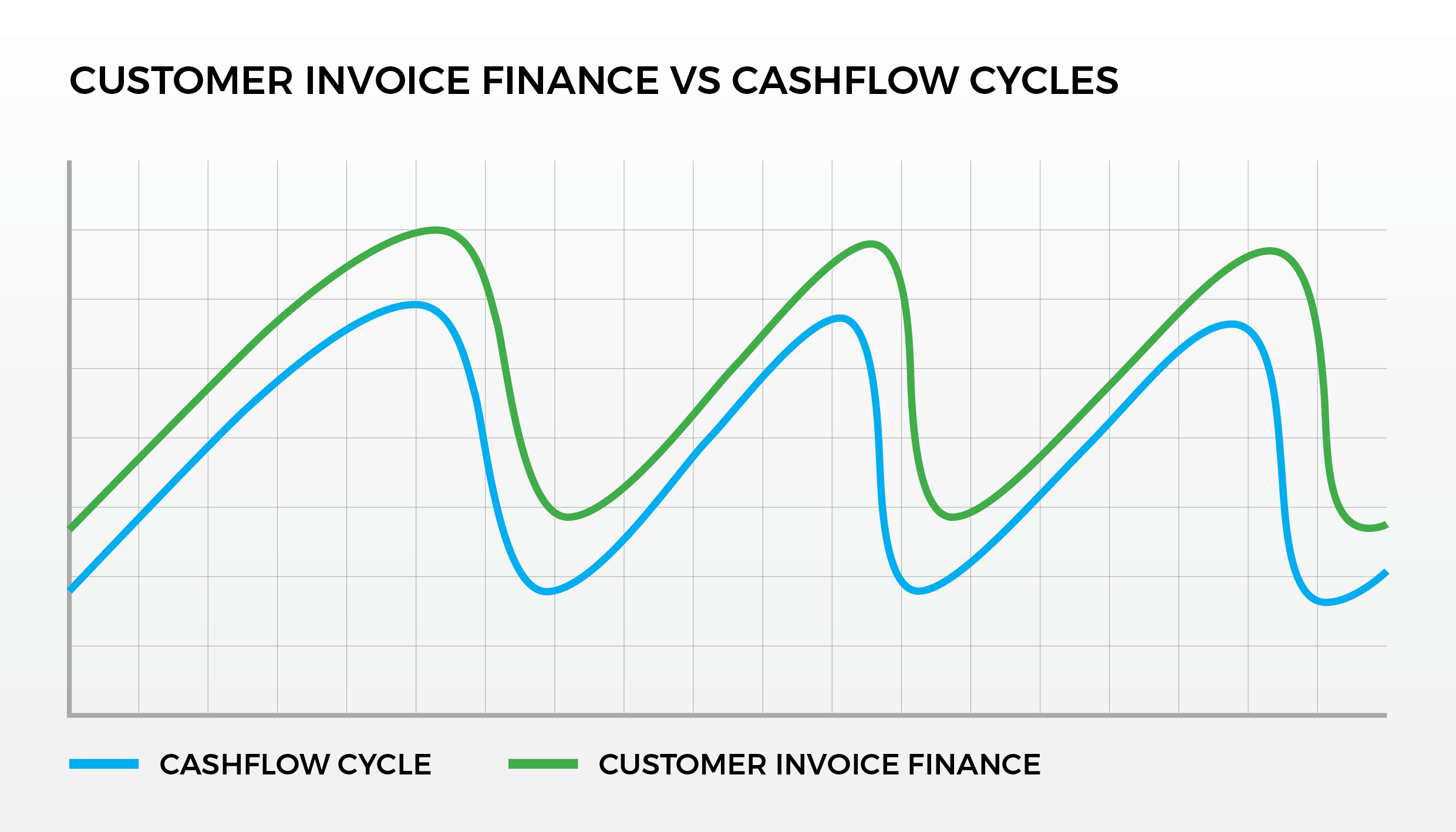

Customer Invoice Finance

Alternatively, another popular solution to managing cashflow that businesses owners have been using for many years is Customer Invoice Finance. Customer Invoice Finance works by enabling cashflow based on your existing invoices waiting to be paid, allowing you to borrow up to 80% of the amount owed to you.

The advantage of Customer Invoice Finance is that you can borrow repeatedly as it is your own cashflow, by accessing your cashflow when submitting your invoices and borrowing against them. This allows you to replenish the cash you have outlaid generating your sales and growth. Plus, as payments are received from Customers, the finance is automatically repaid meaning the bookkeeping takes care of itself.

Unlike a Fintech Loan, you don’t borrow based on your bank statements, which is great if you are just starting out. Customer Invoice Finance synchronises with the business cashflow cycle demonstrated by the green line below (see image 2). This shows the sufficient finance available to cover each peak of the cashflow cycle because cost plus profit and taxes like the GST are already built into the value of Customer invoices.

Image 2

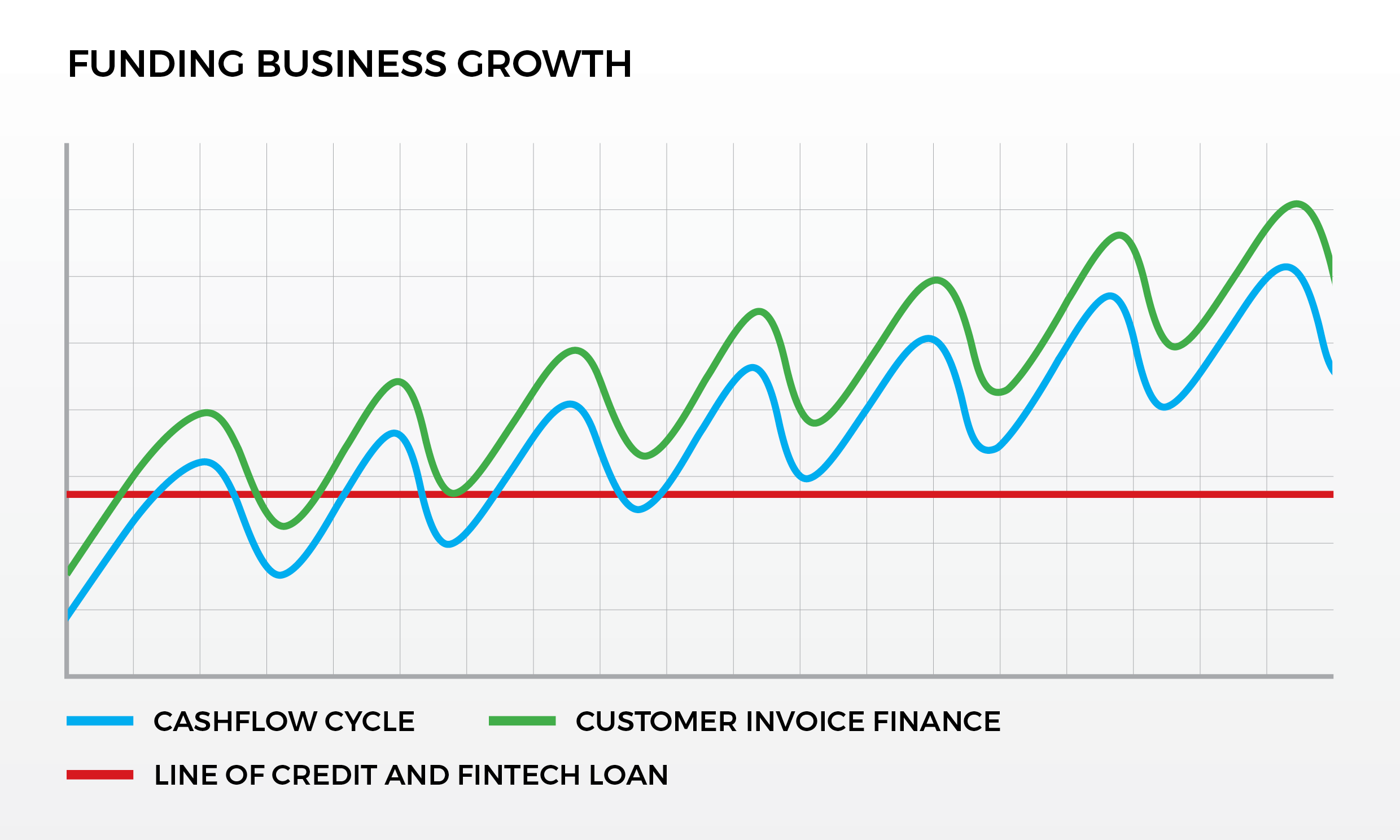

Another key benefit that keeps attracting businesses to Customer Invoice Finance is its ability to automatically scale with business growth. As businesses grow and expand over time, so do their cashflow commitments. Customer Invoice Finance illustrated by the green line (refer image 3) grows over time in line with increasing cashflow requirements shown by the blue line.

Successful businesses are not constrained by property values that have no link to business performance so why hold your business back. So even if the fluctuation is quite large you have the ability to stay on top of your financial requirements and keep growing.

Image 3

It is important to understand your options when considering the right finance solution for your business. Whether it be a onetime Fintech Loan based on your bank statements, or ongoing Customer Invoice Finance accessing your own money on invoice, effectively managing cashflow cycles allows for a more resilient and successful business.

To find out more on which solution we think is right for you, please contact us for further information on AddCash Customer Invoice Finance.