Debtor Finance, Invoice Finance, Factoring, Customer Invoice Finance, Cashflow Finance, Accounts Receivable Finance, and more: What is the difference?

- Posted by Duografik

- On May 17, 2019

- 0 Comments

- accounts receivable finance, business finance, cashflow finance, customer invoice finance, debtor finance, factoring, invoice finance

Financing a business through its receivable invoices is not a new concept. In fact, its roots can be traced to over 4,000 years ago when the foundations were laid in Ancient Mesopotamia.

This method was then commonly used across ancient Egypt and Greece, and then kept developing in Europe through the Middle Ages and Renaissance. Today, there are many businesses who specialise in offering the service, as it has the potential to aid growth of a business that typically struggles with Cashflow.

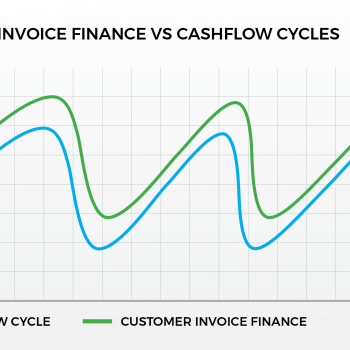

Although it was developed thousands of years ago, the concept tends to confuse people, especially those who are not well versed in the language of finance. In reality, the process is quite simple. Receive up to 80% of the money owed to you by your customers up front, instead of having to wait a week, month or even longer for them to pay. This gives your business the ability to buy more stock, invest in equipment or pay wages and taxes on time. When your customers eventually pay, you will receive the remaining 20%, minus any fees. It really is quite simple.

Naming the process is not so simple. There are so many different names for the same service that there is no wonder businesses are confused. Debt Factoring, Debtor Finance, Invoice Finance, Customer Invoice Finance, Accounts Receivable Finance, Cashflow Finance, Invoice Discounting – the list could go on. Are there any differences between these services?

In short, the answer is no.

The base service supplied is the same. Some businesses will tell you that Debtor Finance is an umbrella term and that the rest of the names are all slightly different forms of the same thing. AddCash Finance likes to keep things simple and has therefore decided to call it AddCash Customer Invoice Finance. Rates, fees and terms will change between lenders, so as with any loan, it is important to understand which terms and conditions apply before taking out finance.

This name allows both people in the finance industry and the average person in a small business to immediately gain an understanding of the service, whether you know what a “debtor” is or not.

AddCash Customer Invoice Finance comes in two different forms – Disclosed and Confidential. This means AddCash Finance can team up with you and your staff to work directly with your Customers or operate in the background leaving your Customers unaware of your partnership with AddCash. It is that simple.

Improving Cashflow in your business is straight forward. Contact AddCash Finance today to find out how AddCash Customer Invoice Finance can help your business grow or download the eBook 5 Effective Cashflow tips.