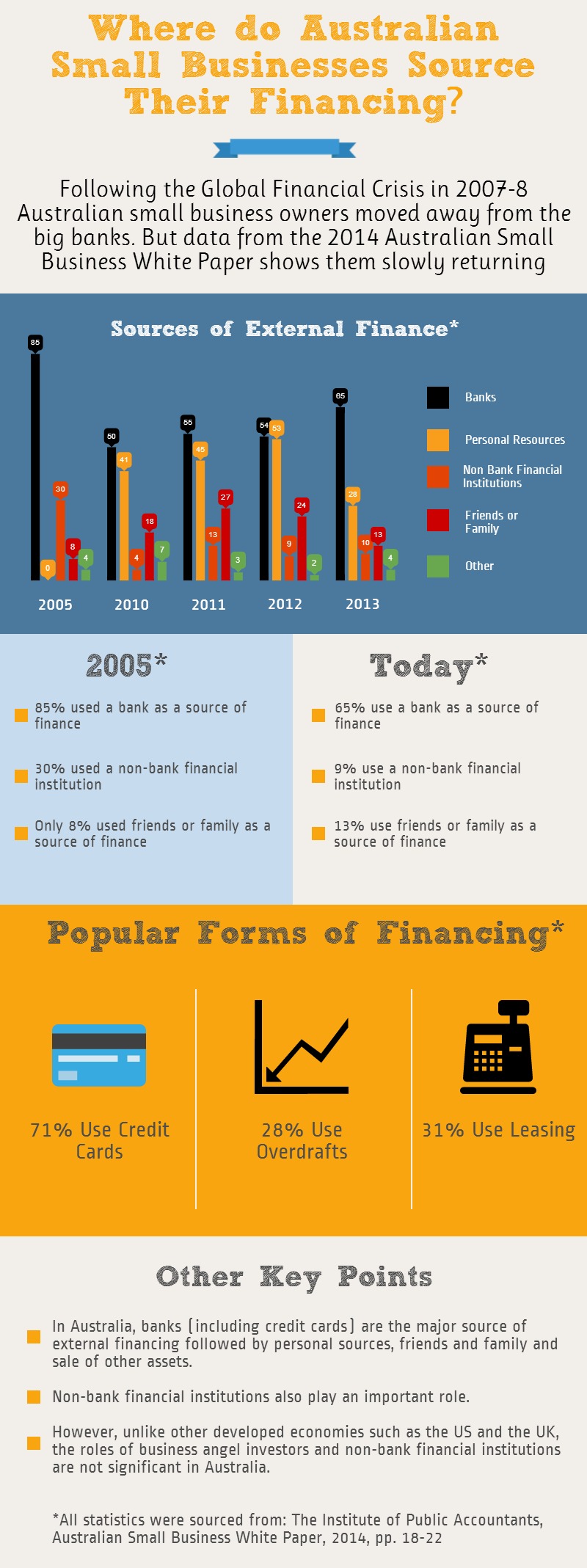

Where do Australian Small Businesses Source Their Financing?

- Posted by Duografik

- On August 18, 2016

- 0 Comments

- Small business

The recent release of the Australian Small Business White Paper should give hope to those small businesses who in recent years have failed to qualify for bank finance. After some tough years following the 2007-8 global financial crisis, when small business owners were tapping into credit cards, personal loans and even their home loans for financing, it appears that small businesses are once again qualifying for business loans.

“Sources of finance are viewed as major obstacles and challenges to business growth,” Institute of Public Accountants chief executive Andrew Conway says. “In many cases, small business people are placing their family homes and well-being on the line as they drive their passion for their business.”

The Australian Small Business White Paper released late last month by the Institute of Public Accountants shows that just how tough securing small business finance has been over the past five years. In 2005, 85 per cent of small businesses sourced at least a portion of their finance from a major bank, whereas only 8 per cent used friends and family for financial loans. However, by 2011 these figures had completely transformed, with only 55 per cent receiving business loans from the bank and 27 per cent borrowing money from their friends and family. Yet, as of 2013 this seems to be correcting itself.

Families and friends can be a reliable source of funds during troubled times, but the risks of not repaying are twofold. Not only can borrowing money from loved ones hurt you financially, but the knock on effect of owing family and/or friends money can cause damage to a business owner’s personal life.

Dun and Bradstreet research points to tools such as invoice finance being increasingly used in the post global financial crisis market place as a means of tying businesses over until bills are paid. Invoice financing, or finance factoring, is a good way for businesses to maintain their cash flow at times when it’s hard to secure business loans.

For a visual overview of where Australian small businesses source their financing based on the findings from the Australian Small Business White Paper see the info-graphic below.